Post Office Monthly Income Scheme 2025: The Post Office Monthly Income Scheme (POMIS) 2025 is one of the most trusted and secure small savings schemes offered by India Post. It is designed especially for individuals who want to earn a fixed monthly income from their savings without taking high risks. Managed by the Government of India, this scheme is suitable for retirees, senior citizens, and anyone looking for stable returns with guaranteed income. The Post Office Monthly Income Scheme 2025 ensures financial stability and is considered one of the safest investment options in India.

Post Office Monthly Income Scheme (POMIS) 2025

The Post Office Monthly Income Scheme 2025 is a government-backed savings plan that provides a steady monthly income to investors. It is suitable for those who prefer low-risk investments with guaranteed returns. Once an individual deposits a lump sum amount in the post office, they start receiving a fixed monthly interest based on the deposited amount and the prevailing interest rate. After the completion of five years, the entire principal amount can be withdrawn or reinvested.

Post Office Monthly Income Scheme 2025 Overview

| Particulars | Details |

|---|---|

| Scheme Name | Post Office Monthly Income Scheme (POMIS) 2025 |

| Launched By | Government of India |

| Operating Authority | Department of Posts (India Post) |

| Investment Type | Small Savings Scheme |

| Minimum Investment | ₹1,000 |

| Maximum Investment (Single Account) | ₹9 lakh |

| Maximum Investment (Joint Account) | ₹15 lakh |

| Interest Rate (as of 2025) | 7.4% per annum (subject to change quarterly) |

| Lock-in Period | 5 years |

| Mode of Payment | Monthly Interest Payout through Post Office or Bank Account |

| Official Website | www.indiapost.gov.in |

Key Features of Post Office MIS 2025

- Safe and Reliable: It is backed by the Government of India, making it one of the safest investment options.

- Guaranteed Monthly Income: The investor receives interest every month, providing a steady flow of income.

- Flexible Account Options: Individuals can open either a single or joint account.

- Nomination Facility: Investors can nominate a family member to receive the benefits in case of the investor’s demise.

- Transferable Account: The account can be easily transferred from one post office to another across India.

Eligibility Criteria for Post Office MIS 2025

To open a Post Office Monthly Income Scheme account, the following eligibility criteria must be met:

- The applicant must be an Indian resident.

- The minimum age requirement is 10 years (for minors, accounts can be opened jointly with a guardian).

- Non-resident Indians (NRIs) are not eligible to invest.

- Both individuals and joint account holders can open the scheme.

How to Open a Post Office Monthly Income Scheme Account

Opening a POMIS account is simple and can be done at any post office branch. Follow the steps below:

- Visit the nearest post office with the required documents.

- Collect and fill out the POMIS Account Opening Form.

- Attach photocopies of your Aadhaar card, PAN card, passport-size photo, and address proof.

- Deposit the investment amount either by cash or cheque.

- Choose your preferred mode of monthly interest payout (either directly into your bank account or via post office).

- The account will be activated after successful verification.

You May Also Like

- Aadhaar Card Update 2026, Aadhaar Holders Alert on New Verification Rules Starting January 2026

- TSBIE Hall Ticket 2026, Download TS Intermediate Practical and Theory Admit Card @ Tgbie.cgg.gov.in

- NABARD Development Assistant Recruitment 2026, Apply Online for 162 Vacancies

- JKBOSE 10th Class Result 2025 Update, Expected Date, Official Website, Marks Detail

- JKBOSE 10th Class Date Sheet 2025 Released, Check Check Exam Date @ www.jkbose.nic.in

Documents Required

To open a POMIS account, the following documents are mandatory:

- Aadhaar Card

- PAN Card

- Address Proof (Voter ID, Passport, or Utility Bill)

- Passport-size Photograph

- Birth Certificate (for minors, if applicable)

Benefits of Post Office Monthly Income Scheme 2025

The Post Office MIS 2025 offers numerous advantages to investors:

- Guaranteed Monthly Returns: The investor earns a steady income every month without worrying about market fluctuations.

- No Market Risk: Since it is a government-backed scheme, the investment is completely secure.

- Suitable for Retired Persons: It is an ideal choice for retirees who need a regular source of income.

- Premature Withdrawal Option: Investors can withdraw their funds before the completion of five years by paying a small penalty.

- Reinvestment Option: After maturity, the investor can reinvest the amount in the same or another post office scheme.

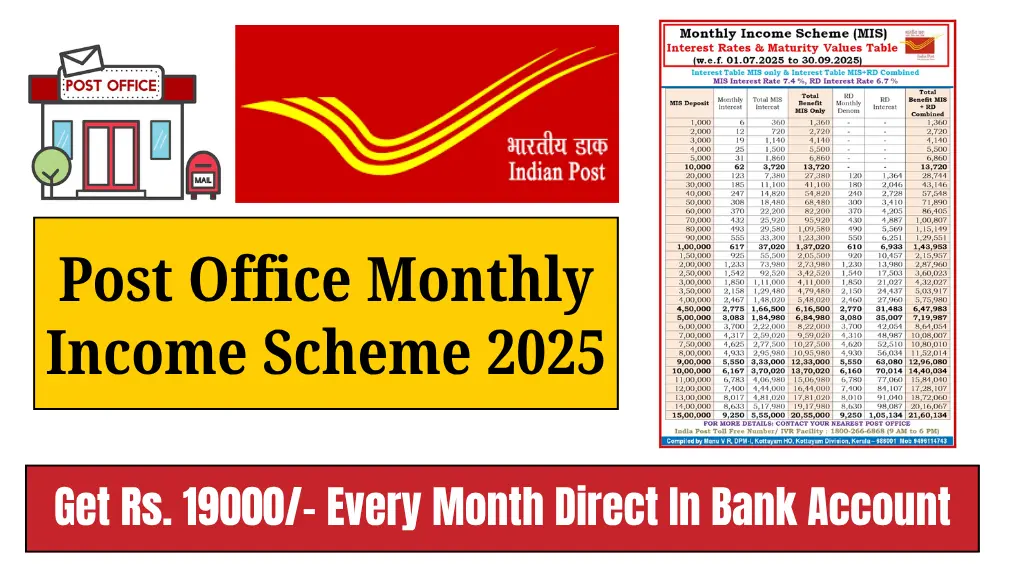

Interest Rate and Calculation

As of 2025, the Post Office Monthly Income Scheme interest rate is 7.4% per annum. The interest is calculated monthly and credited to the investor’s account. For example, if you invest ₹9,00,000 in POMIS, you will receive approximately ₹5,550 per month as interest. The rates may change quarterly based on government notifications.

Important Points to Remember

- The lock-in period for this scheme is five years.

- Interest not withdrawn monthly will not earn additional interest.

- The scheme can be transferred between post offices easily.

- Joint account holders can invest up to ₹15 lakh in total.

FAQs

The minimum investment is ₹1,000, while the maximum is ₹9 lakh for individuals and ₹15 lakh for joint accounts.

Yes, you can withdraw your investment after one year with a small deduction as a penalty.

Yes, the interest income is taxable under the Income Tax Act, but no TDS (Tax Deducted at Source) is applied automatically.

The Post Office Monthly Income Scheme 2025 is a perfect investment plan for those who want regular monthly income with zero market risk. With attractive interest rates and government backing, it offers a reliable way to ensure financial stability, especially for senior citizens and risk-averse investors. If you are looking for a secure and steady return option, POMIS 2025 is an excellent choice to consider.

“My Name Is Mawin Shafi and my goal is to help students and aspirants understand important educational information without confusion. Access to correct information should be simple, transparent, and available to everyone.”